Stearns Weaver Miller Individual Disability Insurance (IDI) Benefit

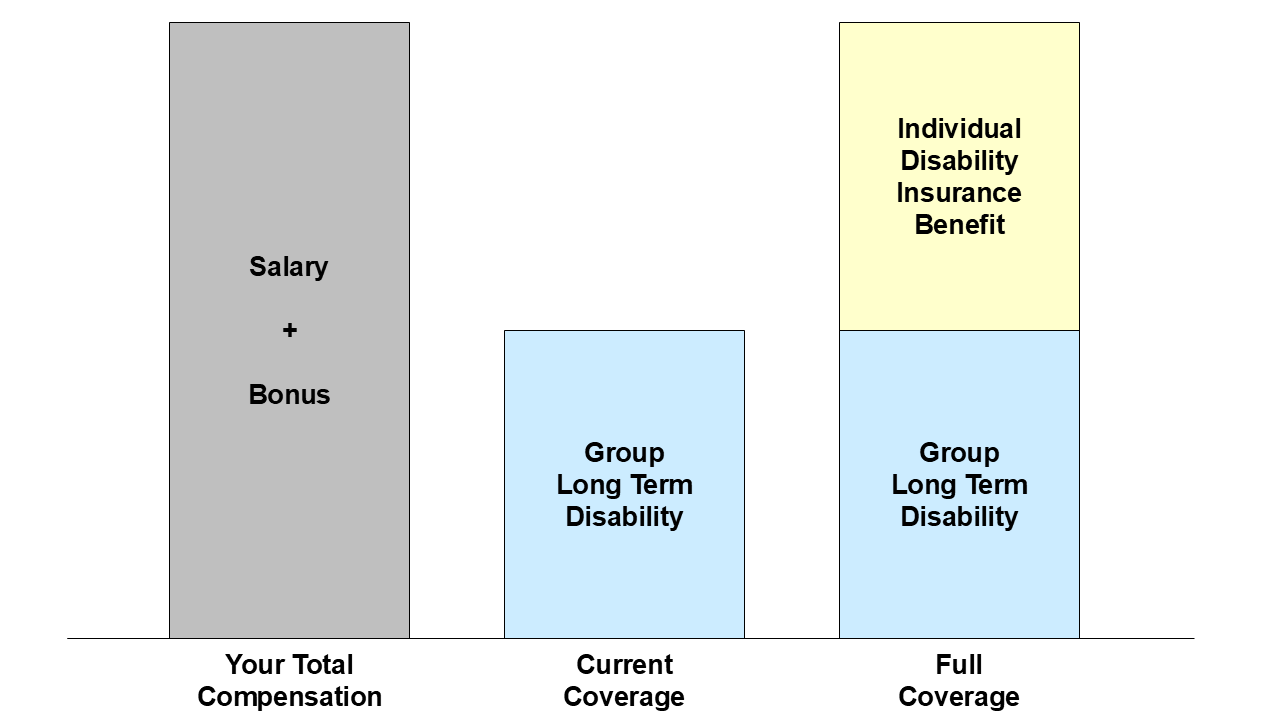

We are pleased to inform you that you are now eligible for the new Stearns Weaver Miller Individual Disability Insurance (IDI) benefit provided by Guardian. This coverage is important because it helps protect more of your total compensation in case an accident or illness impairs your ability to work and earn income.

Enroll by April 4, 2025

How does this Work?

Why do I Need This?

Plan Details and Features

Frequently Asked Questions

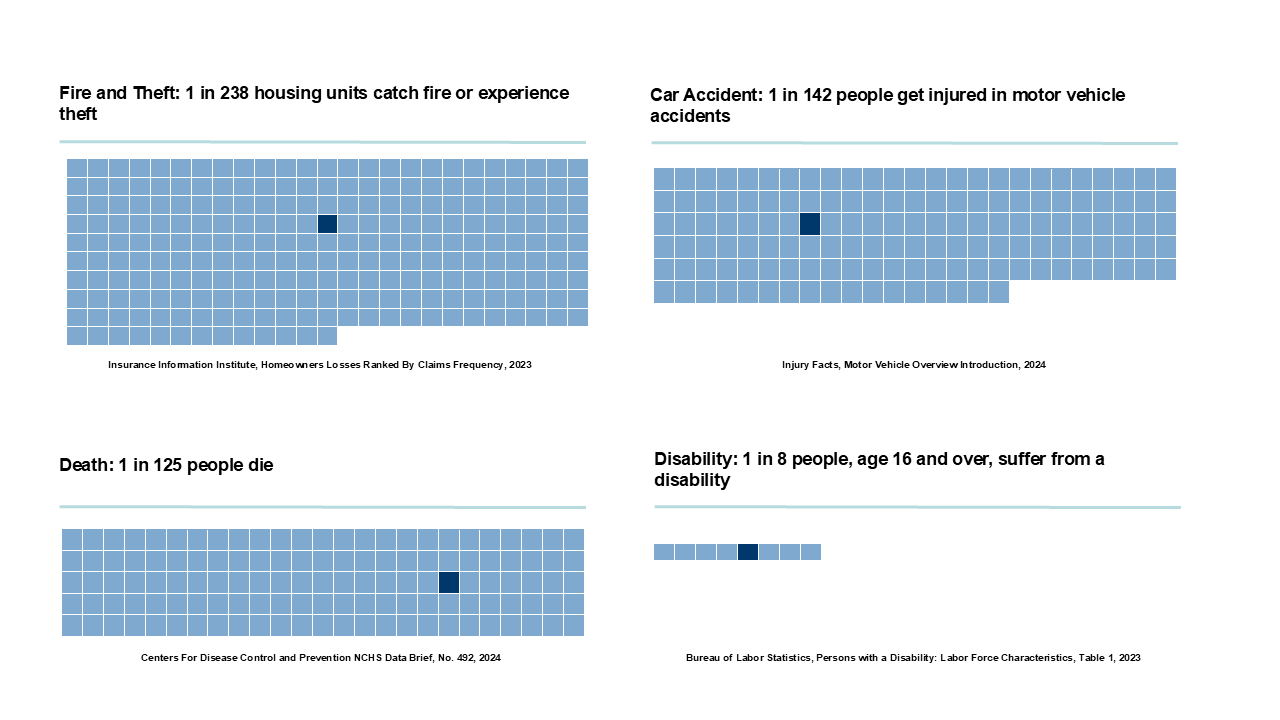

Disability insurance is designed to replace your earnings if you are unable to work because of an illness or an accident. Statistics indicate that long-term disability is a fundamental financial risk.

Many remain unaware of the probability of disability compared to other insurable risks. People routinely acquire insurance coverage to protect against the risk of premature death or property damage. However, a long-term disability is far more likely to occur than premature death and the consequences can be financially disastrous.

Yes. Stearns Weaver Miller has negotiated a 25% discount through Guardian’s corporate-sponsored rates.

You should consider your sources of income from employment, your savings and other investments. Next, estimate how much you and your family would need to maintain your standard of living. In addition, you should consider how much additional annual savings you would need to generate in order to cover education expenses and retirement income.

You are not likely to find comparable coverage at the rates offered here. Stearns Weaver Miller has negotiated a 25% discount from Guardian.

Benefits are payable up to age 67 (or longer if disability occurs after age 64).

No. Your premiums are guaranteed until the longer of five years or to age 67 as long as premiums are paid in a timely fashion. Once your Individual Disability Insurance policy is issued and premiums are paid in a timely fashion, the contractual provisions will not be changed.

As long as you have been continuously at work full-time without restrictions or limitations for the past 90 days, and not currently disabled, and you sign up for the benefit by the enrollment deadline, your policy will be issued regardless of your health status.

Yes. The coverage does not end should you leave Stearns Weaver Miller. As long as you continue paying premiums directly to Guardian, your coverage will continue, uninterrupted, even if you leave Stearns Weaver Miller.

The basic Internal Revenue Service rule is simple: If you pay the premiums with after-tax dollars, any benefits you receive will be income tax-free. If your company pays the premiums, any benefits you receive will be income taxable.

Benefits are paid to you on a monthly basis after 90 days of an approved disability.

Contact Us

If you have any questions about the Stearns Weaver Miller IDI benefit, please contact NFP Executive Benefits, our administrative service provider, at (855) 583-3932 or via e-mail at IDIBenefit@nfp.com.