Hybrid Life Insurance/Long-Term Care (LTC) Solution

We are excited to announce that Novo Nordisk is providing you access to a hybrid Life Insurance/Long-Term Care solution through Trustmark. Rates are based on your age at the time of enrollment, so the sooner you enroll, the lower your rate. Once enrolled, your rate will never increase due to your age or if you leave Novo Nordisk. To be eligible for the enrollment, employees must be actively working 20 or more hours a week and not on a leave of absence. You (and your spouse/domestic partner) have a one-time opportunity to apply for this coverage without the full underwriting process within 30 days of your hire date.

Click the button below to view your options and enroll

Key Features

Why do I Need This?

Plan Details and Features

Frequently Asked Questions

Long-Term Care services consist of qualified care received in a facility or at home for treatment of cognitive impairment or the loss of two or more of the Activities of Daily Living: Bathing; Continence; Dressing; Eating; Going to the Toilet; and Transferring. *

* State Variations may apply. Please consult your policy for complete details. Benefits, definitions, exclusions and limitations, naming conventions and availability may vary by state. The LTC Benefit is a Long-Term Care benefit rider and is an acceleration of the death benefit and is not Long-Term Care Insurance (except in FL, LA and VA, where the LTC benefit is Long-Term Care Insurance). This is different from a traditional long-term care policy or state-partnership program. It does not provide Medicaid asset protection or tax deductibility. It does, however, ensure that even if you don’t need to pay for long-term care expenses your family will have access to additional life insurance benefits and the build-up of cash value. Acquiring this benefit does not preclude you from also purchasing a traditional long-term care policy on your own.

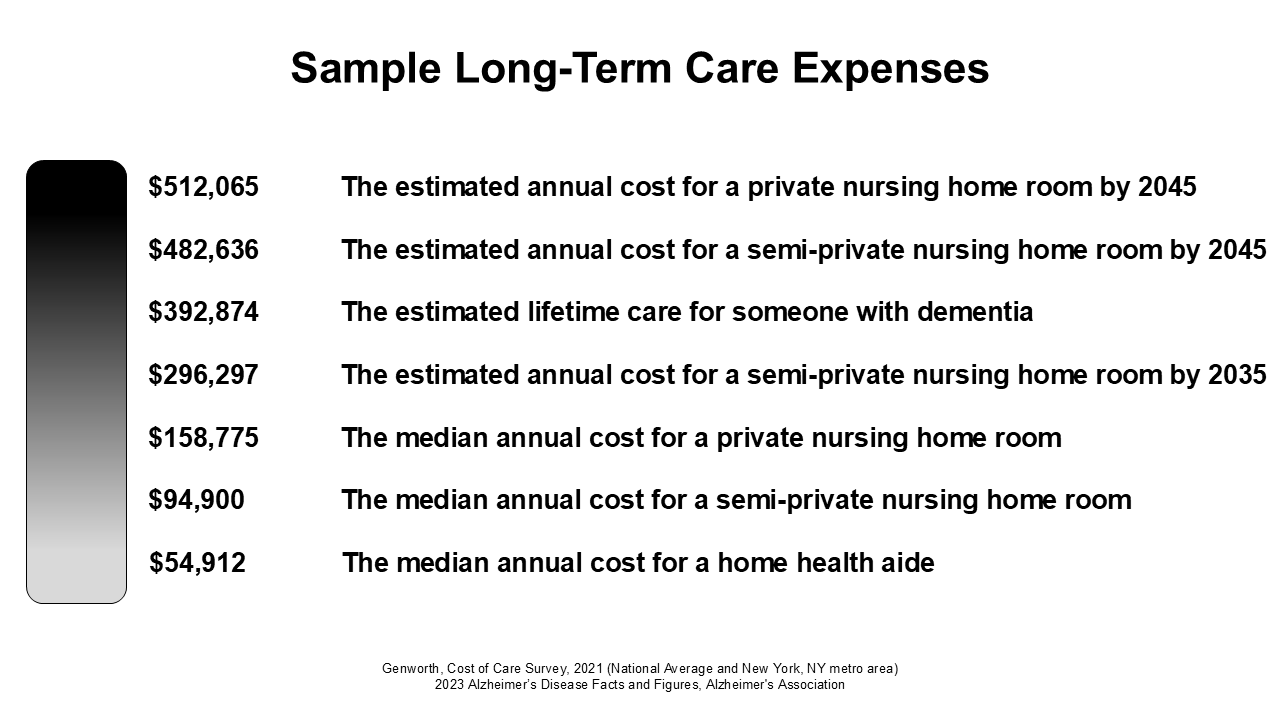

Approximately 2 in 3 people turning age 65 will need some type of paid LTC services in their lifetime. 1 Often, family members are left responsible for this care. According to recent research, nearly half of Americans that have provided care or have a close friend or family member who has, have reported to have had at least one financial impact on their life; with many of them reporting to have had a physical toll from caregiving. 2

1 Department of Health and Human Services Long Term Care Information, 2020.

2 Caregiving in the U.S. 2020, National Alliance for Caregiving and AARP.

The younger you are when you enroll, the lower your rate. Your rate will never increase due to age or if your employment ends for any reason. The younger you are when you enroll, the sooner the policy’s cash value grows, and only during this initial enrollment period you have an opportunity to apply without the full underwriting process.

You are purchasing a Universal Life insurance policy with a Long-Term Care (LTC) rider. Each month that you qualify for long-term care, 4% of the policy face amount is accelerated and paid to you for up to a total of 50 months, resulting in total LTC payout equal to two times your policy face amount. Additionally, this offer includes a Restoration rider, which means if you qualify and use your long-term care benefit, this does not result in reduction of your death benefit. For example, if your policy’s face amount is $200,000, your monthly long-term care benefit is 4% of $200,000 = $8,000. The $8,000 monthly benefit X 50 months = $400,000. The death benefit remains at $200,000.

The LTC Benefit is an acceleration of the death benefit and is not Long-Term Care Insurance (except in FL, LA and VA, where the LTC benefit is Long-Term Care Insurance). With the built in Restoration rider, the payment of LTC benefits does not reduce the available death benefit. This is different from a traditional long-term care policy or state-partnership program. It does not provide Medicaid asset protection or tax deductibility. It does, however, ensure that even if you don’t need to pay for long-term care expenses your family will have access to additional life insurance benefits and the build-up of cash value. Acquiring this benefit does not preclude you from also purchasing a traditional long-term care policy on your own.

This offer is underwritten by Trustmark Insurance Company, which is rated A (Excellent) for financial strength by A.M. Best. Plan forms GUL.205/IUL.205 and applicable riders are underwritten by Trustmark Insurance Company, Lake Forest, Illinois. In New York, plan form IUL.205 NY and applicable riders are underwritten by Trustmark Life Insurance Company of New York, Albany, New York.

During your initial 30-day enrollment window, you can enroll without the full underwriting process. You will not have to undergo a physical exam, give blood or urine, or submit to a cognitive test. You may need to answer a few health history questions depending on your age and/or benefit amount selected. This offer includes the EZ Value option (for those age 60 or younger) through which benefit amount increases at a rate equivalent to an incremental $1 of weekly premium on each anniversary date for the first ten years of the policy. There is no additional underwriting required for these increases, and they may be declined/cancelled at any time.

Full illustrations are mailed to the home address on file at the time of policy issuance. There is also an annual report mailed to the home address on file which provides activity over the past year. The report shows the effect of paying no further premiums both on a current and guaranteed basis. Your illustration will show your actual values, but generally, based on annual target premium payments, the policy and premiums are designed to make it to age 100 on a current basis. (Current credited interest rate is 3%).

No. The younger you are when you enroll, the lower your rate. Your rate will never increase due to age or if you leave your employer through retirement or any other reason.

Yes, you may always decrease or cancel your coverage at any time. If you choose to cancel or decrease your benefit, and want to re-enroll at a later date, you may be subject to the full underwriting process and your premium will be based on your age at the time you re-enroll.

Yes, you will be able to enroll in the future, however, you will be subject to the full underwriting process and your premium will be based on your age at the time of enrollment.

The LTC rider does not pay benefits for loss due to a Pre-existing Condition that starts during the first six months after the effective date. A Pre-existing Condition means during the six months immediately prior to the Effective Date of the rider: Sickness or Injury for which medical care, diagnosis or advice was received or recommended; or the existence of symptoms which would have caused an ordinarily prudent person to seek medical care, treatment, diagnosis or advice. *

The maturity date of the policy is the policy anniversary after the insured reaches age 100. At the maturity date, the cash value of the policy is paid out and the contract expires. The target cash value at maturity date is intended to be similar to, but may not be equal to, the death benefit. The actual value could be higher (if interest rates increase) or lower (if interest rates decrease).

To date, Trustmark has never increased cost of insurance or expense charges for this current generation Universal Life product since its inception in 2005. In the event cost of insurance or expense charges increased and/or interest rates decreased, there would still be no change to your premium. However, your annual report and illustration will reflect these changes and indicate the revised policy maturity date (i.e. coverage may end sooner than age 100). You will also have the option to increase your premium payments to maintain the targeted maturity date based on an attained age of 100.

*State Variations may apply. Please consult your policy for complete details. Benefits, definitions, exclusions and limitations, naming conventions and availability may vary by state. The LTC Benefit is a Long-Term Care benefit rider and is an acceleration of the death benefit and is not Long-Term Care Insurance (except in FL, LA and VA, where the LTC benefit is Long-Term Care Insurance). This is different from a traditional long-term care policy or state-partnership program. It does not provide Medicaid asset protection or tax deductibility. It does, however, ensure that even if you don’t need to pay for long-term care expenses your family will have access to additional life insurance benefits and the build-up of cash value. Acquiring this benefit does not preclude you from also purchasing a traditional long-term care policy on your own.

It is a fixed monthly amount. This is an indemnity benefit which means the cash is paid directly to you regardless of what your actual expenses are. If you have a long-term care need, the benefits will be paid directly to you.

Yes, if you get married in the future, you can add coverage for your spouse/ domestic partner to your elected benefit, but they will need to go through the evidence of insurability (EOI) process.

No, this coverage is only available for employees and their spouse or domestic partner.

No. This is often referred to as the hybrid solution. You are purchasing a Universal Life insurance policy with a Long-Term Care (LTC) rider. Each month that you qualify for long-term care, 4% of the policy face amount is accelerated and paid to you for up to a total of 50 months, resulting in total LTC payout equal to twice your policy face amount.

Long-Term Care (LTC) benefits will only be paid if the covered individual is receiving care in the USA (including U.S. territories) or Canada. The Life insurance policy will be paid to the applicable beneficiary regardless of residency.

The Long-Term Care LTC benefit does not have a cost-of-living adjustment. However, there is a buildup of cash value over time. This can be withdrawn or borrowed against. This offer also includes the EZ Value option (for those age 60 or younger) through which benefit amount increases at a rate equivalent to an incremental $1 of weekly premium on each anniversary date for the first ten years of the policy. There is no additional underwriting required for these increases, and they may be declined/cancelled at any time.

Universal Life policies are funded by premium payments. Each month, some of that premium is applied to the Cost of Insurance and to other Fees, Expense Charges, and in this case, Expense for the LTC Riders (all of which are defined in the policy). What is remaining will have Interest credited to it and then carry over to the next month where new premiums are collected, and the process continues throughout the life of the policy. This is how the Cash Value is built up. You will receive an illustration of this cash value with your policy.

There is also an annual report which provides activity over the past year. The report shows the effect of paying no further premiums both on a current and guaranteed basis. Your illustration will show your actual values, but generally, based on annual target premium payments, the policy and premiums are designed to make it to age 100 on a current basis. (Current credited interest rate is 3.0%).

The state of Washington was the first state to put a State Long-Term Care benefit in effect. This is funded by an uncapped payroll tax of $0.58 per $100. Since it’s uncapped, this means the more you earn, the more premiums you will pay. The Washington State Long-Term Care (LTC) benefit is a fixed monthly benefit of $3,000, is only available for 12 months and the benefit must be used in the state of Washington. There is an opt out for this, meaning if you can show that you have your own Long-Term Care (LTC) coverage, you can opt out of the state plan and tax. There are about a dozen other states that have some sort of similar legislation going. We don’t know if those will have the same look or have an opt out option. We do know the policies available through Trustmark are considered eligible for opt out under the Washington State Plan.

The LTC rider does not pay benefits for loss due to a Pre-existing Condition that starts during the first six months after the application date. A Pre-existing Condition means during the first six months immediately prior to the Effective Date of the rider: Sickness or Injury for which medical care, diagnosis or advice was received or recommended; or the existence of symptoms which would have caused an ordinarily prudent person to seek medical care, treatment, diagnosis or advice. If this rider provides replacement coverage for other long-term care coverage, credit will be given for any pre-existing period satisfied under the prior coverage. Benefits may not be available in all states or may be named differently. Benefits, definitions, exclusions and limitations may vary by state.

Contact Us

If you have any questions about the hybrid Life Insurance/Long-Term Care solution, please contact our administrative service provider, NFP, at (877) 513-1480 or via email at LTC@nfp.com. They can help you understand the plan and the different options available to you.

Please note that this hybrid Life Insurance/Long-Term Care solution is a voluntary benefit that is not subject to ERISA. Novo Nordisk is not contributing to the cost of coverage or receiving consideration if you enroll.