Odyssey Long-Term Care (LTC) Solution

For a limited time, Odyssey is providing you with the opportunity to acquire insurance coverage for long-term care (LTC) expenses without submitting to the full underwriting process.

This solution – term life insurance coverage with a benefit acceleration rider for chronic illnesses * – can provide peace of mind to you and your family that these LTC expenses are planned for with the added value of additional benefits.

Click the button below to view your options and enroll

How does this Work?

Why do I Need This?

Plan Details and Features

Frequently Asked Questions

Long-Term Care services consist of qualified care received in a facility or at home for treatment of cognitive impairment or the loss of two or more of the Activities of Daily Living: Bathing; Continence; Dressing; Eating; Going to the Toilet; and Transferring. *

* The LTC expense protection benefit is an Accelerated Death Benefit for Chronic Illness rider and is an acceleration of the death benefit and is not Long-Term Care Insurance. This is different from a traditional long-term care policy or state-partnership program. It does not provide Medicaid asset protection or tax deductibility. It does, however, ensure that even if you don’t need to pay for long-term care expenses your family will have access to additional life insurance benefits. Acquiring this benefit does not preclude you from also purchasing a traditional long-term care policy on your own.

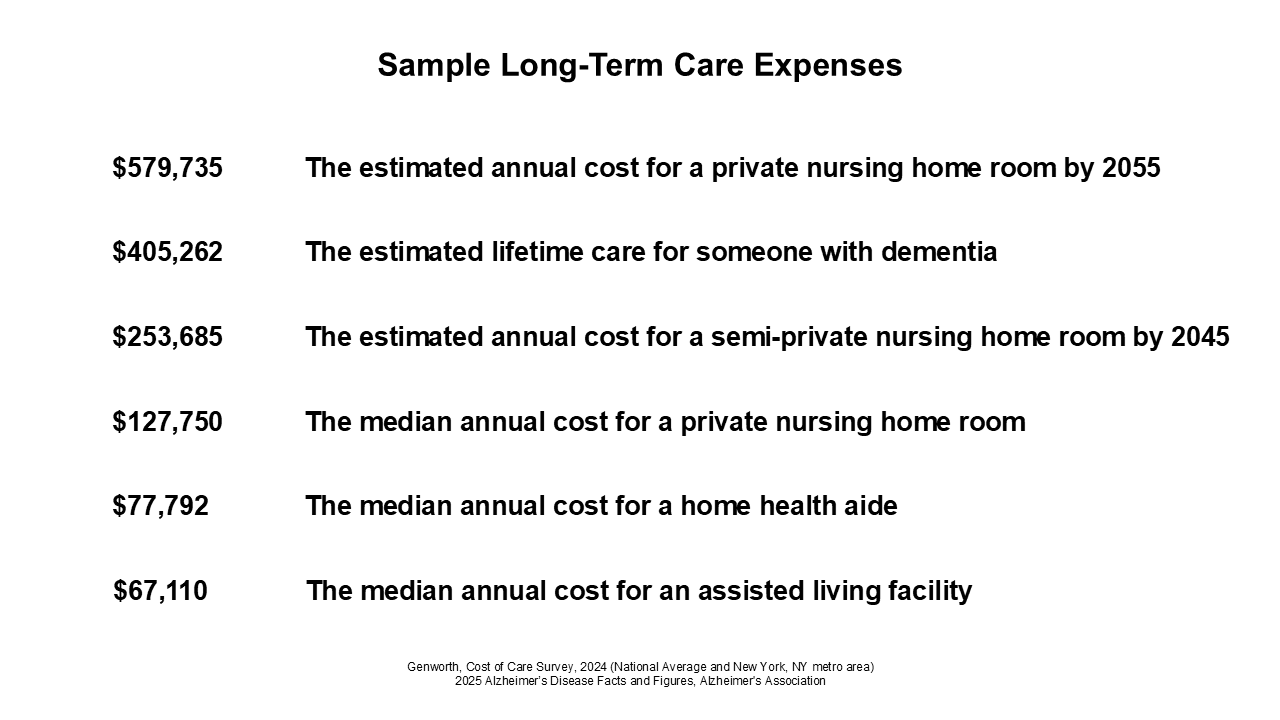

Approximately 1 in 2 people turning age 65 will need some type of paid LTC services in their lifetime. * Often, family members are left responsible for this care. According to recent research, nearly half of Americans that have provided care or have a close friend or family member who has, have reported to have had at least one financial impact on their life; with many of them reporting to have had a physical toll from caregiving. **

* Actuarial Analysis of Long-Term Services and Supports Reform Proposals, Millman, 2025.

** National Alliance for Caregiving and AARP, Caregiving in the U.S., 2025.

The younger you are when you enroll, the lower your rate. Life insurance rates will never increase due to age or if you leave your employer through retirement or any other reason. And only through this special offer are you able to bypass the full medical underwriting process.

You are purchasing life insurance coverage with LTC expense protection in the form of an Accelerated Death Benefit for Chronic Illness (CI) rider.

Each month that you have qualified LTC expenses, 4% of the policy face amount is accelerated and paid to you for up to a total of 25 months, resulting in total LTC expense payout equal to your policy face amount.

For example, if your policy’s face amount is $150,000, your monthly long-term care benefit is 4% of $150,000 = $6,000. The $6,000 monthly benefit X 25 months = $150,000. Each acceleration will also reduce your death benefit amount by the same amount. In this example, the $150,000 would reduce to $144,000 in the first month of LTC expense payment and so on.

However, this offer also includes the restoration rider, which restores your death benefit after CI expense payment 50% up to a maximum of $50,000.

The LTC Benefit is an acceleration of the death benefit and is not Long-Term Care Insurance (except in FL, LA and VA, where the LTC benefit is Long-Term Care Insurance). With the built in Restoration rider, the payment of LTC benefits does not reduce the available death benefit. This is different from a traditional long-term care policy or state-partnership program. It does not provide Medicaid asset protection or tax deductibility. It does, however, ensure that even if you don’t need to pay for long-term care expenses your family will have access to additional life insurance benefits and the build-up of cash value. Acquiring this benefit does not preclude you from also purchasing a traditional long-term care policy on your own.

This offer is underwritten by Combined Insurance Company of America and marketed under the Chubb brand. Chubb National Insurance Company is rated A++ (Superior) for financial strength by A.M. Best.

Through this offer only, you are able to acquire this coverage while bypassing the full medical underwriting process. You will not have to undergo a physical exam, give blood or urine, or submit to a cognitive test. You may need to answer a few health history questions depending on your age and/or benefit amount selected.

The younger you are when you enroll, the lower your rate. Your rate will never increase due to age or if you leave your employer through retirement or any other reason. In fact, life insurance premium will never increase and are guaranteed through age 100. After age 100 no premium is due. Please note that Chronic Illness Care rider premiums are not guaranteed and may be increased with state approval. To date, this insurance carrier has not executed any such price increases.

Life insurance premium will never increase and are guaranteed through age 100. After age 100, no premium is due but coverage will continue to age 121.

After 10 years, paid-up benefits begin to accrue. At any point thereafter, if an employee stops paying premium, a reduced paid-up benefit is issued and can never lapse. That means an employee who retires can stop paying premium and have a death benefit for the rest of their life – guaranteed.

Yes, you may always decrease or cancel your coverage at any time.

Contact Us

If you have any questions about Odyssey’s LTC solution, please contact NFP Executive Benefits, our administrative service provider, at (877) 513-1480 or via e-mail at LTC@nfp.com.