XYZ Company Supplemental Individual Disability Insurance (IDI) Benefit

We are pleased to inform you that you are eligible to enroll in a Supplemental Individual Disability Insurance (IDI) benefit provided by Guardian.

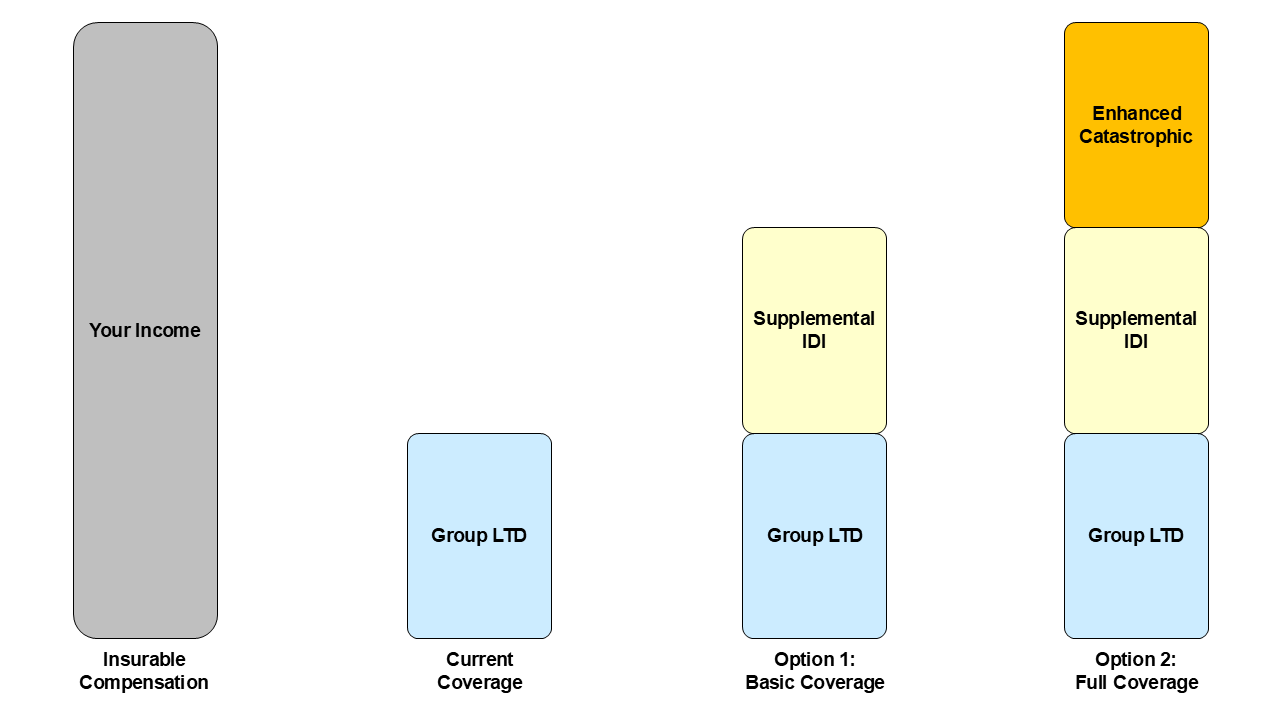

XYZ Company currently provides basic Long-Term Disability (LTD) coverage equaling 40% of your base salary and bonus. Through this supplemental coverage, you can increase your LTD coverage to include coverage on your total compensation with premium discounts without needing to submit Evidence of Insurability.

Enroll by January 31, 2025

How does this Work?

Why do I Need This?

Plan Details and Features

Frequently Asked Questions

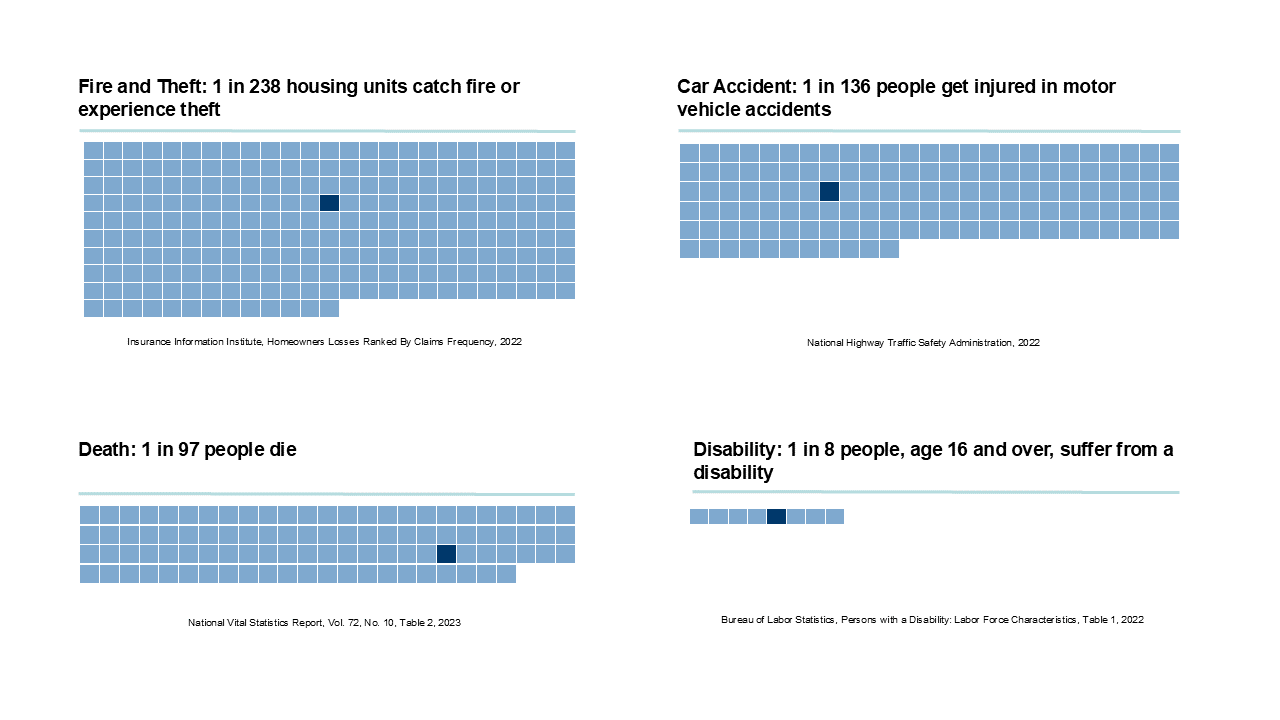

Disability insurance is designed to replace your earnings if you are unable to work because of an illness or an accident. Statistics indicate that long-term disability is a fundamental financial risk.

Many remain unaware of the probability of disability compared to other insurable risks. People routinely acquire insurance coverage to protect against the risk of premature death or property damage. However, a long-term disability is far more likely to occur than premature death and the consequences can be financially disastrous.

Yes. XYZ Company has negotiated a 25% discount through Guardian’s corporate-sponsored rates.

You should consider your sources of income from employment, your savings and other investments. Next, estimate how much you and your family would need to maintain your standard of living. In addition, you should consider how much additional annual savings you would need to generate in order to cover education expenses and retirement income.

You are not likely to find comparable coverage at the rates offered here. XYZ Company has negotiated a 25% discount from Guardian.

Benefits are payable up to age 67 (or longer if disability occurs after age 64).

No. Your premiums are guaranteed until the longer of five years or to age 67 as long as premiums are paid in a timely fashion. Once your Supplemental Individual Disability Insurance policy is issued and premiums are paid in a timely fashion, the contractual provisions will not be changed.

As long as you have been continuously at work full-time without restrictions or limitations for the past 90 days, and not currently disabled, and you sign up for the benefit by the enrollment deadline, your policy will be issued regardless of your health status.

Yes. The coverage does not end should you leave XYZ Company. As long as you continue paying premiums directly to Guardian, your coverage will continue, uninterrupted, even if you leave XYZ Company.

The basic Internal Revenue Service rule is simple: If you pay the premiums with after-tax dollars, any benefits you receive will be income tax-free. If your company pays the premiums, any benefits you receive will be income taxable.

Benefits are paid to you on a monthly basis after 90 days of an approved disability.

Contact Us

NFP Executive Benefits is the service administrator that will be processing this enrollment with Guardian. If you have any questions about the Supplemental IDI benefit, please contact them at (855) 583–3932 or via email IDIBenefit@nfp.com.